BISP Payment Withdrawal Guide 2025

The Benazir Income Support Programme (BISP) is a cornerstone of Pakistan’s social welfare system, providing financial assistance to low-income families to combat poverty. In 2025, BISP will continue to empower millions, particularly women, widows, and disabled individuals, with quarterly payments of PKR 13,500 under the Benazir Kafalat scheme. The 8171 program is the backbone for eligibility verification and payment distribution, ensuring transparency and accessibility. This comprehensive guide details how to withdraw BISP funds in Pakistan using various methods, including ATMs, mobile wallets, and bank branches, while addressing eligibility criteria and troubleshooting common issues.

- To qualify for BISP in 2025, beneficiaries must

- Be Pakistani citizens with a valid CNIC.

- Have a household income below PKR 25,000 per month.

- Be registered with BISP through the 8171 portal or NADRA.

- Prioritize vulnerable groups like widows, divorced women, and disabled individuals.

BISP Withdrawal Options Comparison (2025)

| Withdrawal Method | Availability | Biometric Required | Fee | Max Daily Limit | Convenient For |

|---|---|---|---|---|---|

| HBL ATM | Nationwide | Yes | Free | Rs. 25,000 | Urban/Rural ATM Users |

| Bank Alfalah | Selected Branches | Yes | Free | Rs. 25,000 | Those with Alfalah nearby |

| Bank of Punjab | Limited Branches | Yes | Free | Rs. 25,000 | Punjab-based beneficiaries |

| JazzCash | Nationwide (Agents) | Yes | Varies (Rs. 30-50) | Rs. 15,000 | Mobile-friendly users |

| EasyPaisa | Extensive Network | Yes | Varies (Rs. 30-50) | Rs. 15,000 | Rural areas |

| Telenor Microfinance Bank | Branches & Agents | Yes | Free | Rs. 15,000 | Telenor SIM holders |

Withdraw BISP Funds via HBL ATM

Habib Bank Limited (HBL) is a primary partner for BISP withdrawals, offering a secure and convenient process through its extensive ATM network. This method eliminates long queues at cash centers, making it ideal for urban beneficiaries.

Steps to Withdraw:

- Visit the nearest HBL ATM.

- Select the Thumb Scan option and choose Urdu for ease.

- Press the BISP option on the menu.

- Enter your 13-digit CNIC number.

- Place your thumb on the biometric scanner for verification.

- Select Withdraw Money, enter PKR 13,500, and confirm.

- Collect your cash and keep the receipt.

Benefits of Withdrawing Money From HBL:

- 24/7 access to funds.

- Biometric verification ensures security.

- No need to visit crowded cash centers.

Read our article: How to Withdraw BISP Funds via HBL ATM for a detailed guide.

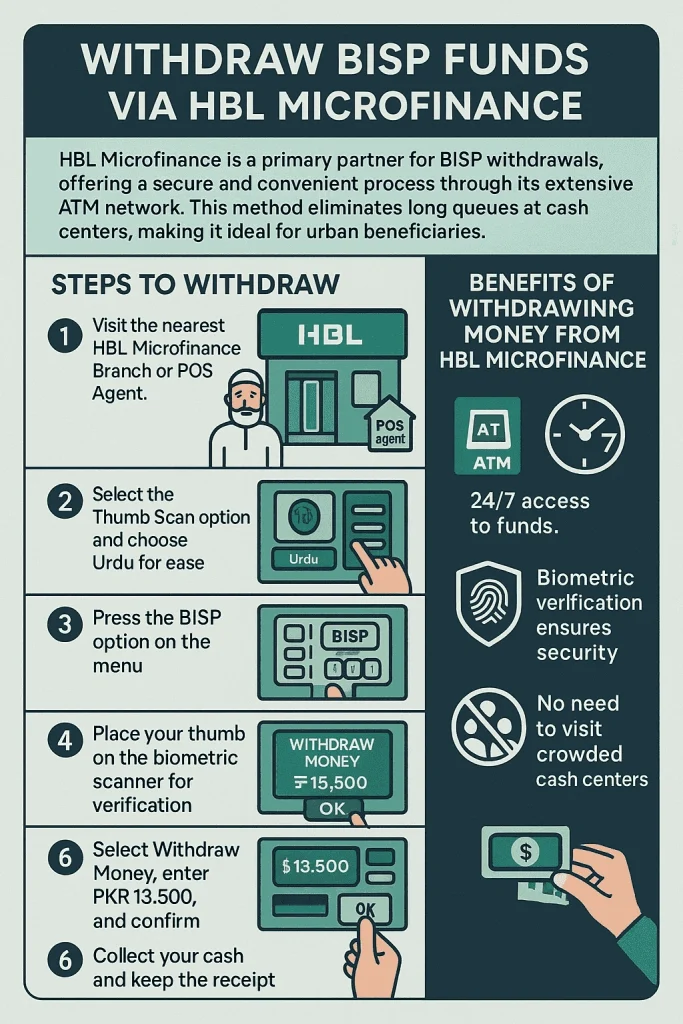

Withdraw BISP Funds via HBL Microfinance

HBL Microfinance is a primary partner for BISP withdrawals, offering a secure and convenient process through its extensive ATM network. This method eliminates long queues at cash centers, making it ideal for urban beneficiaries.

Steps to Withdraw:

- Visit the nearest HBL Microfinance Branch or POS Agent.

- Select the Thumb Scan option and choose Urdu for ease.

- Press the BISP option on the menu.

- Enter your 13-digit CNIC number.

- Place your thumb on the biometric scanner for verification.

- Select Withdraw Money, enter PKR 13,500, and confirm.

- Collect your cash and keep the receipt.

Benefits of Withdrawing Money From HBL Microfinance:

- 24/7 access to funds.

- Biometric verification ensures security.

- No need to visit crowded cash centers.

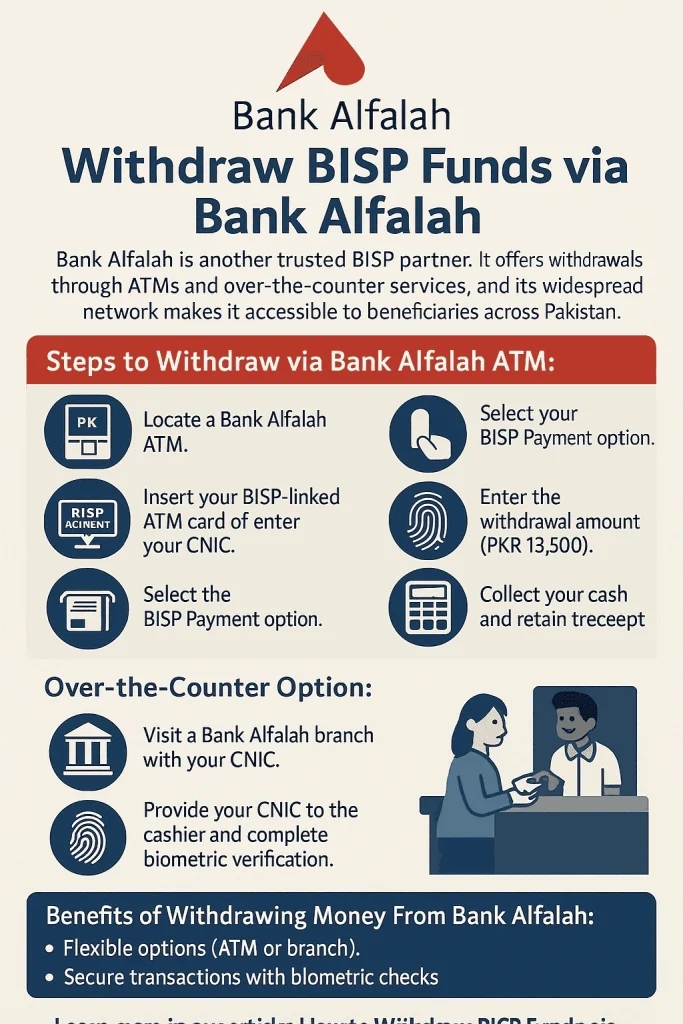

Withdraw BISP Funds via Bank Alfalah

Bank Alfalah is another trusted BISP partner. It offers withdrawals through ATMs and over-the-counter services, and its widespread network makes it accessible to beneficiaries across Pakistan.

Steps to Withdraw via Bank Alfalah ATM:

- Locate a Bank Alfalah ATM.

- Insert your BISP-linked ATM card or enter your CNIC.

- Select the BISP Payment option.

- Complete biometric verification with your thumbprint.

- Enter the withdrawal amount (PKR 13,500).

- Collect your cash and retain the receipt.

Over-the-Counter Option:

- Visit a Bank Alfalah branch with your CNIC.

- Provide your CNIC to the cashier and complete biometric verification.

- Receive your payment in cash.

Benefits of Withdrawing Money From Bank Alfalah:

- Flexible options (ATM or branch).

- Secure transactions with biometric checks.

Learn more in our article: How to Withdraw BISP Funds via Bank Alfalah.

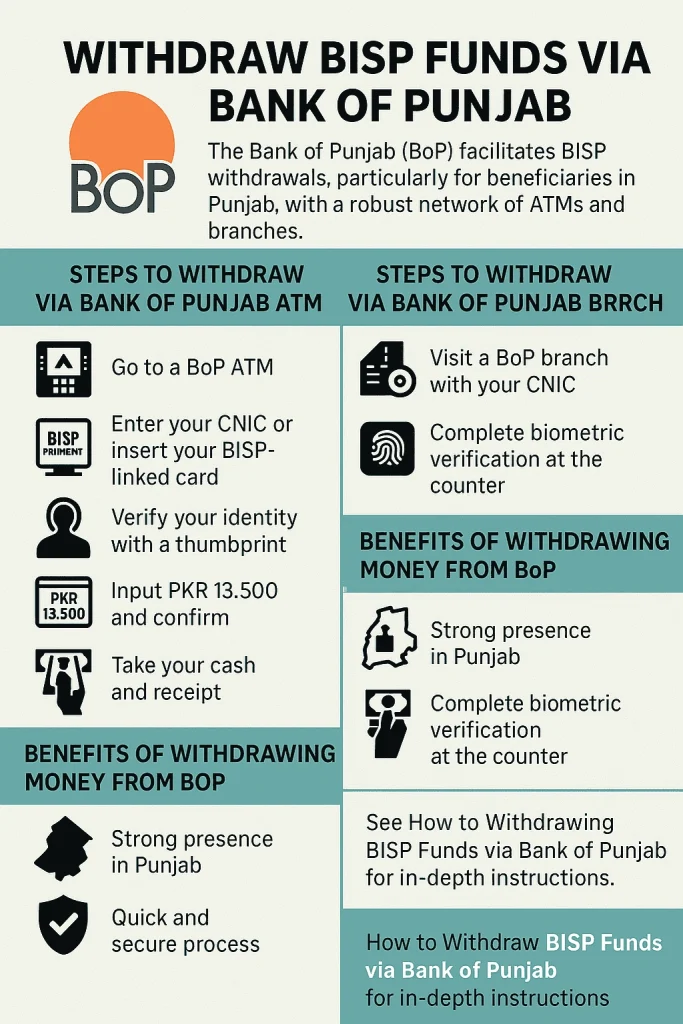

Withdraw BISP Funds via Bank of Punjab

The Bank of Punjab (BoP) facilitates BISP withdrawals, particularly for beneficiaries in Punjab, with a robust network of ATMs and branches.

Steps to Withdraw via Bank of Punjab ATM:

- Go to a BoP ATM.

- Enter your CNIC or insert your BISP-linked card.

- Select the BISP Payment option.

- Verify your identity with a thumbprint.

- Input PKR 13,500 and confirm.

- Take your cash and receipt.

Steps to Withdraw via Bank of Punjab Branch:

- Visit a BoP branch with your CNIC.

- Complete biometric verification at the counter.

- Receive your payment.

Benefits of Withdrawing Money From BoP:

- Strong presence in Punjab.

- Quick and secure process.

See How to Withdraw BISP Funds via Bank of Punjab for in-depth instructions.

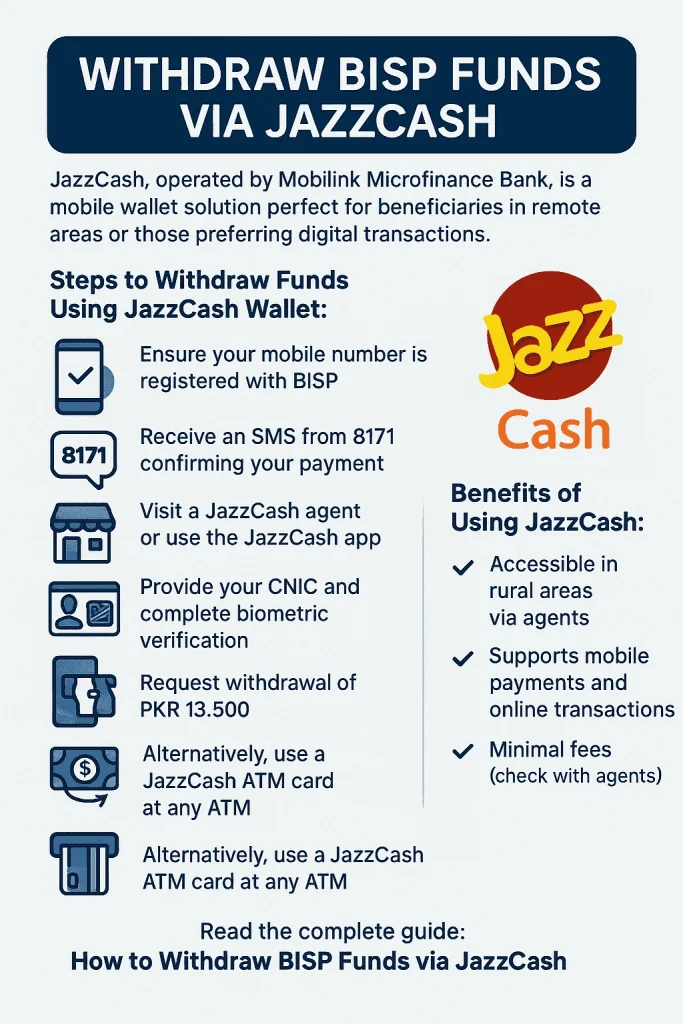

Withdraw BISP Funds via JazzCash

JazzCash, operated by Mobilink Microfinance Bank, is a mobile wallet solution perfect for beneficiaries in remote areas or those preferring digital transactions.

Steps to Withdraw Funds Using JazzCash Wallet:

- Ensure your mobile number is registered with BISP.

- Receive an SMS from 8171 confirming your payment.

- Visit a JazzCash agent or use the JazzCash app.

- Provide your CNIC and complete biometric verification.

- Request withdrawal of PKR 13,500.

- Alternatively, use a JazzCash ATM card at any ATM.

Benefits of Using JazzCash:

- Accessible in rural areas via agents.

- Supports mobile payments and online transactions.

- Minimal fees (check with agents).

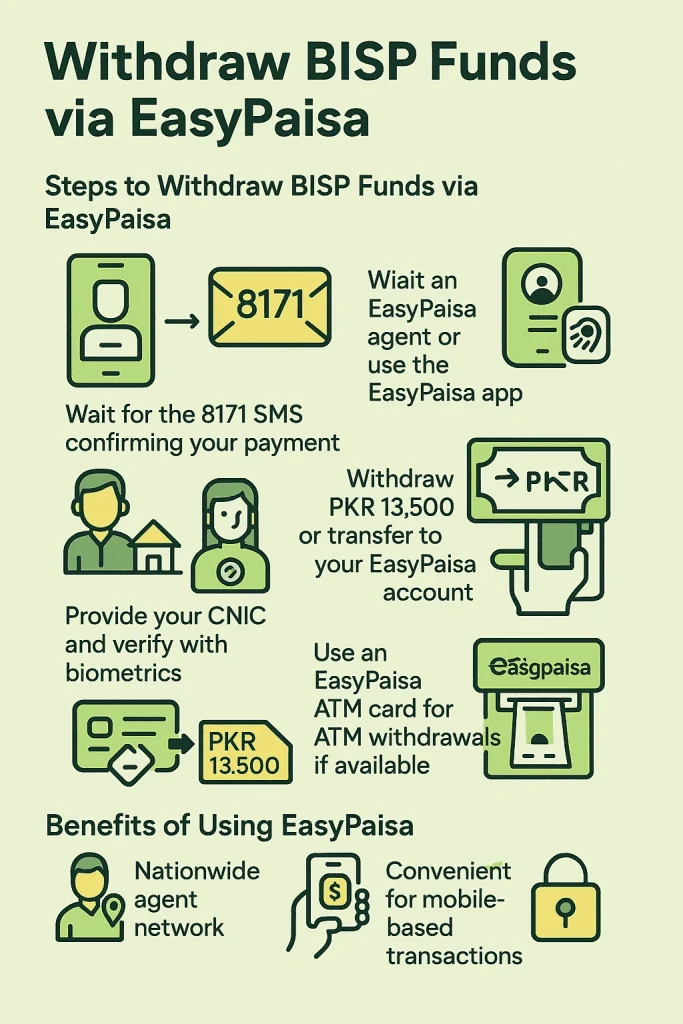

Withdraw BISP Funds via EasyPaisa

Telenor Microfinance Bank supports BISP withdrawals through its growing network, offering beneficiaries mobile wallet and ATM options.

Steps to Withdraw BISP Funds via EasyPaisa:

- Register your mobile number with BISP.

- Wait for the 8171 SMS confirming your payment.

- Visit an EasyPaisa agent or use the EasyPaisa app.

- Provide your CNIC and verify with biometrics.

- Withdraw PKR 13,500 or transfer to your EasyPaisa account.

- Use an EasyPaisa ATM card for ATM withdrawals if available.

Benefits of Using EasyPaisa:

- Nationwide agent network.

- Convenient for mobile-based transactions.

- Secure and fast.

Read the complete guide: How to Withdraw BISP Funds via EasyPaisa.

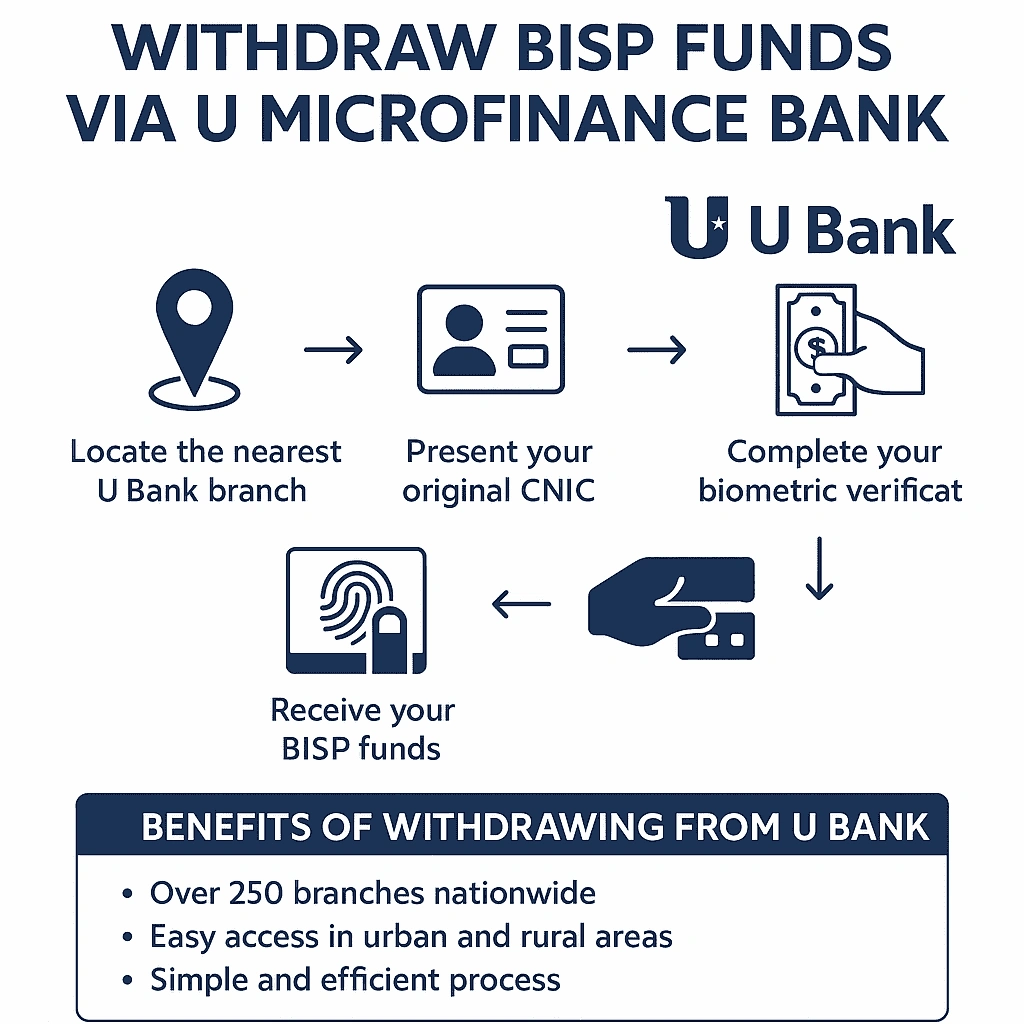

Withdraw BISP Funds via U Microfinance Bank

U Microfinance Bank, commonly known as U Bank, is another BISP disbursement partner. With over 250 branches across 210 cities and rural areas in Pakistan, U Bank facilitates easy access to BISP funds.

Steps to Withdraw BISP Funds From U Bank:

- Locate the nearest U Bank branch.

- Present your original CNIC.

- Complete biometric verification.

- Receive your BISP funds upon successful verification.

Note: It’s advisable to confirm with the branch beforehand to ensure they handle BISP disbursements.

For a complete guide, go on: How To Withdraw BISP Funds via U Microfinance Bank.

Frequently Asked Questions (FAQs)

Final Thoughts

Withdrawing BISP funds in 2025 has become more streamlined and flexible. Whether you prefer using an ATM, bank, or mobile wallet, the options are user-friendly and secure. Bookmark this guide and refer to the individual cluster articles for complete walkthroughs.